Which Business Chequing Account is Right For My Business?

Whether you have a small business you just opened or are in the middle of growing your empire, having a business chequing account is crucial for your success. It’s vital to have an account to fund your business and the product it requires while having easy access to track your spending.

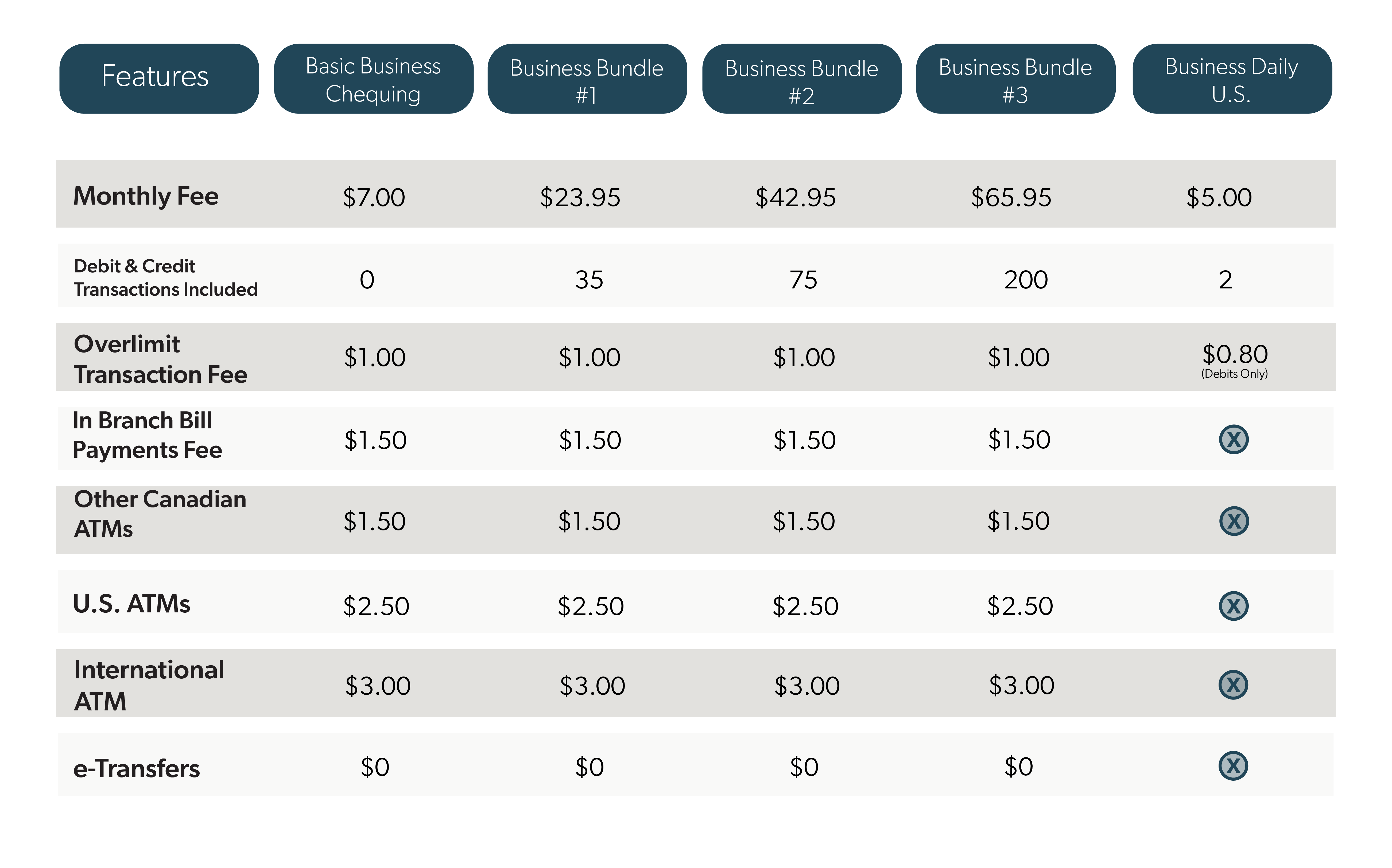

Having a chequing account for your business provides a number of benefits to you and your business. Keeping your business and personal finances separate will aid in future audits and increase credibility with your community. It’s important to choose the right chequing account that suits your business and your plans for growth. Below is an illustration that highlights the different features each 1st Choice Savings business account has.

What do you need to open a business bank account?

Every financial institution requires different documents when opening an account, so the best course of action is to call ahead of time for details. Some commonly required documents may include the following:

For sole proprietorships:

-

Business registration or license

-

Trade name (if applicable)

Additional Option for Corporations and for Organizations:

-

Partnership Registration

-

Partnership Agreement

Kickstart Your Future

Opening a business chequing account will do more than manage your finances; it will help grow and elevate your business. A business bank account is the foundation for improving your finances. If you’re ready to kickstart your business, contact a business advisor today.

Ready to get started? Meet with an advisor!

Related Articles

How to Grow Your Business

Business Account

Structuring Your Business

How to Grow Your Business

Business Account

Structuring Your Business

Search

Search